Reconciling your bank account with activity in CircuiTree is key for seamless reporting for your accounting department. The following article walks through the process of payment processing in Stripe and how to reconcile with CircuiTree and your general ledger.

Process

Here is the process for when you accept a payment via Stripe.

- Credit card payment for $100 is processed on the 1st of the month.

- At the end of the day for credit cards, or once a payment is processed for eCheck, a Merchant Batch is created along with two reports.

- GL Batch Summary – Shows which GL accounts to updated based on where the payment was applied.

- Payment Audit by Merchant Batch – Shows the details of the payment.

- The batch is deposited in your bank 1-3 business days for credit cards or 5-10 business days for eCheck after the payment is processed.

- Credit Cards – 2nd to 4th of month

- eCheck – 8th to 13th of month

Merchant Batch Search

The Merchant Batch Search screen allows you to see the details of a specific Merchant Batch.

Here is the process of how to reconcile using Merchant Batch Search.

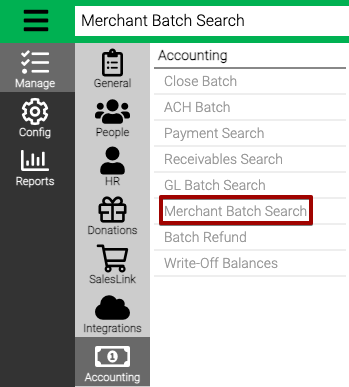

- Go to Manage > Accounting > Merchant Batch Search.

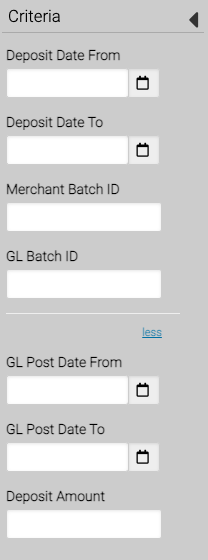

- Enter your Criteria and then select Find.

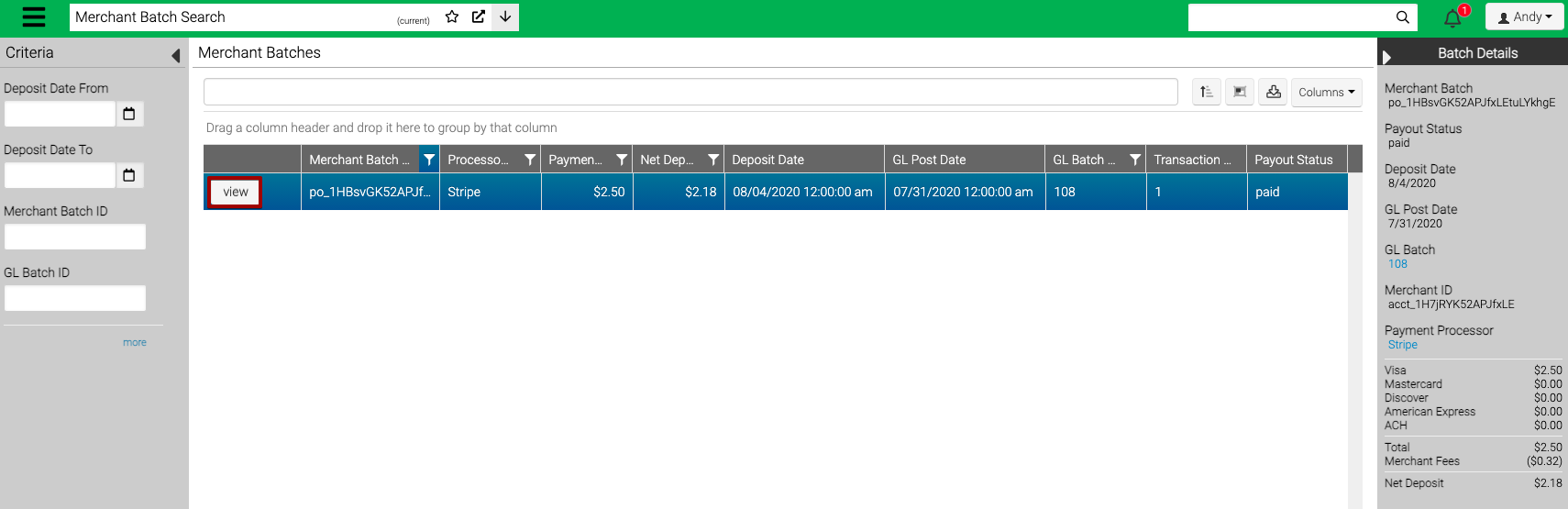

- Find the Merchant Batch to see the details.

- Merchant Batch ID – ID assigned by the payment processor.

- Processor Name – The name of the processor used.

- Payment Total – The amount of payments processed in the batch.

- Net Deposit – The amount that is deposited into your account (Payment Total less fees).

- Deposit Date – The date when the batch was deposited in your account.

- GL Post Date – The date when the batch was posted to GL.

- GL Batch ID – The GL Batch ID that corresponds to the merchant batch.

- Transaction Count – The number of transactions in the batch.

- Payout Status – Displays the current status of the batch.

- Pending – Waiting to be submitted to the bank.

- In Transit – Submitted to bank and waiting for payout.

- Paid – Once the transaction goes through, status changes to Paid.

- Failed / Cancelled – If there is an issue with the batch, it will change to Failed or Canceled within 5 business days. Some failed payouts may initially show as paid but then change to failed.

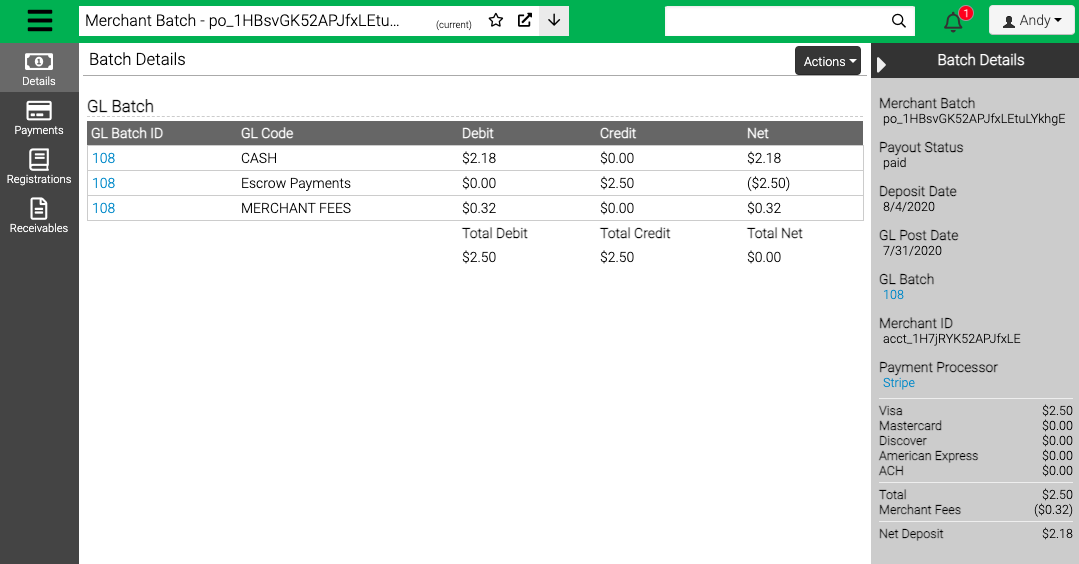

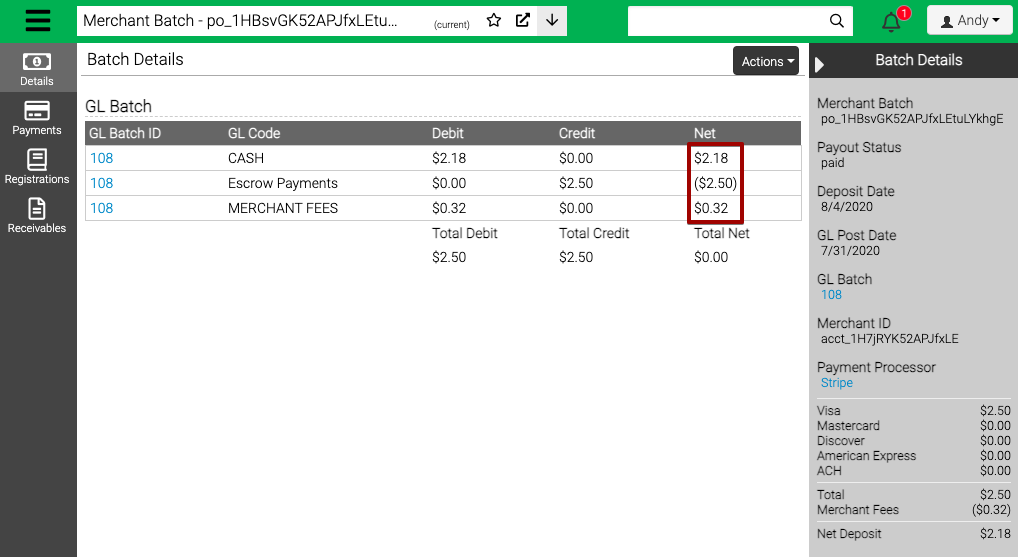

- To see more detail, select View.

- Add three journal entries to your General Ledger based on Net Amount.

- Cash – $2.18

- Escrow Payments – ($2.50)

- Merchant Fees – $0.32

Actions

- To print reports, select Actions and select GL Batch or Payment Audit.

Reports

The following are reports that are generated with each Merchant Batch that is processed.

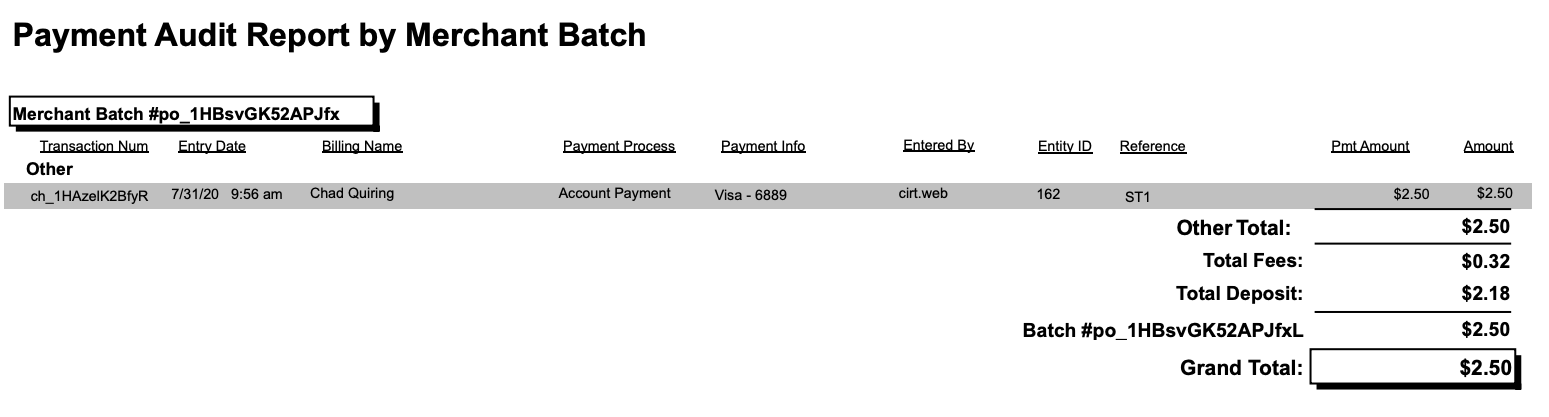

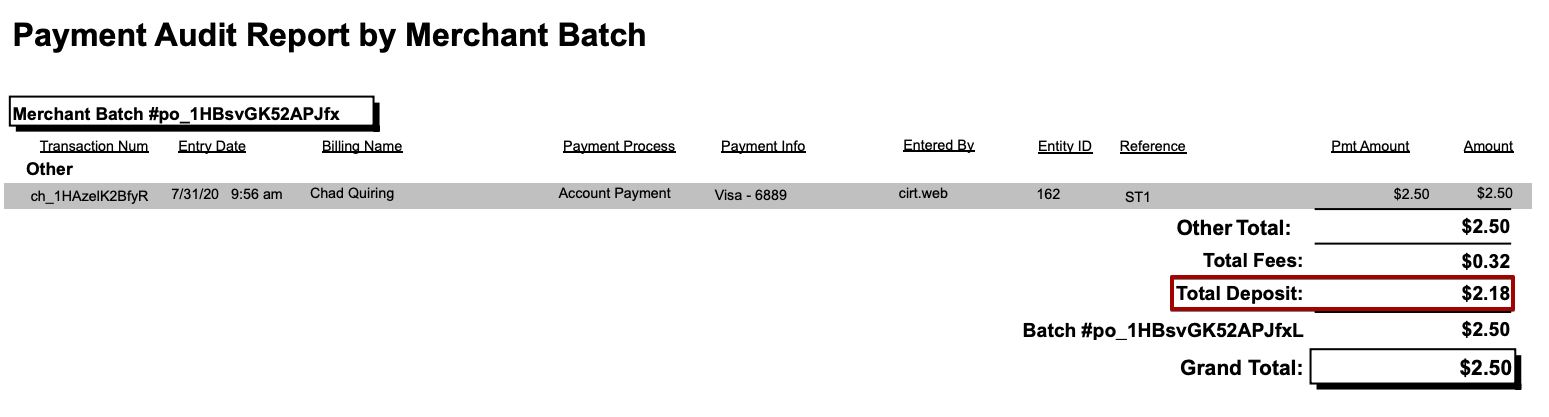

Payment Audit by Merchant Batch

The Payment Audit by Merchant Batch shows a breakdown of all the payments that are part of a Merchant Batch.

- Merchant Batch # – Number used to reference the batch.

- Total – The total amount of payments in the batch.

- Total Fees – The total fees from the batch.

- Total Deposit – The amount that will be deposited into your bank.

- Batch # – The total batch amount.

- Grand Total – The grand total of all the batches (this example only shows one batch).

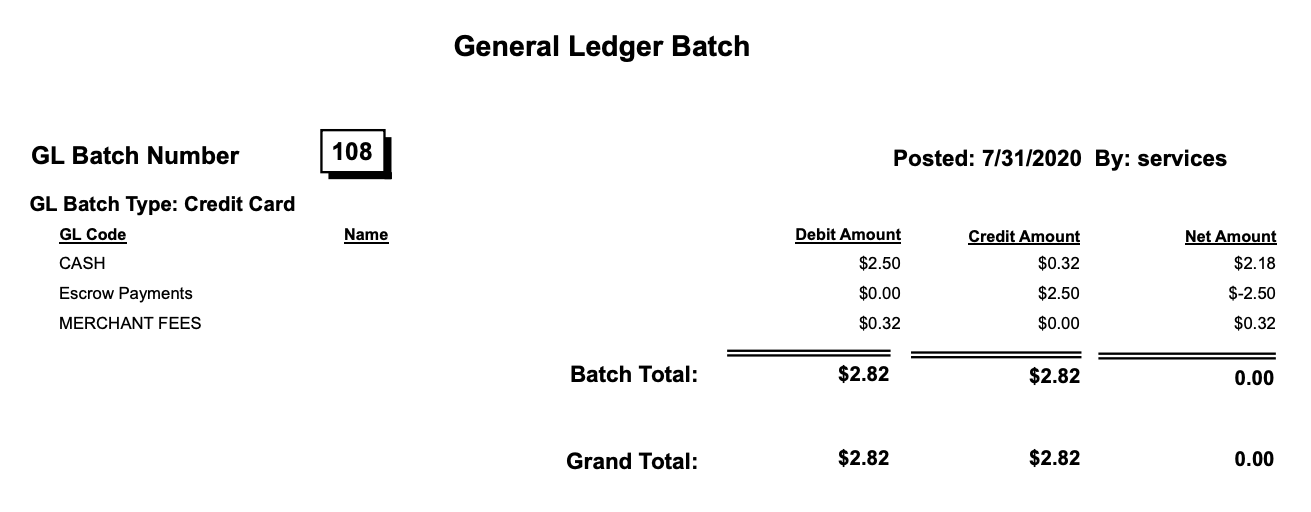

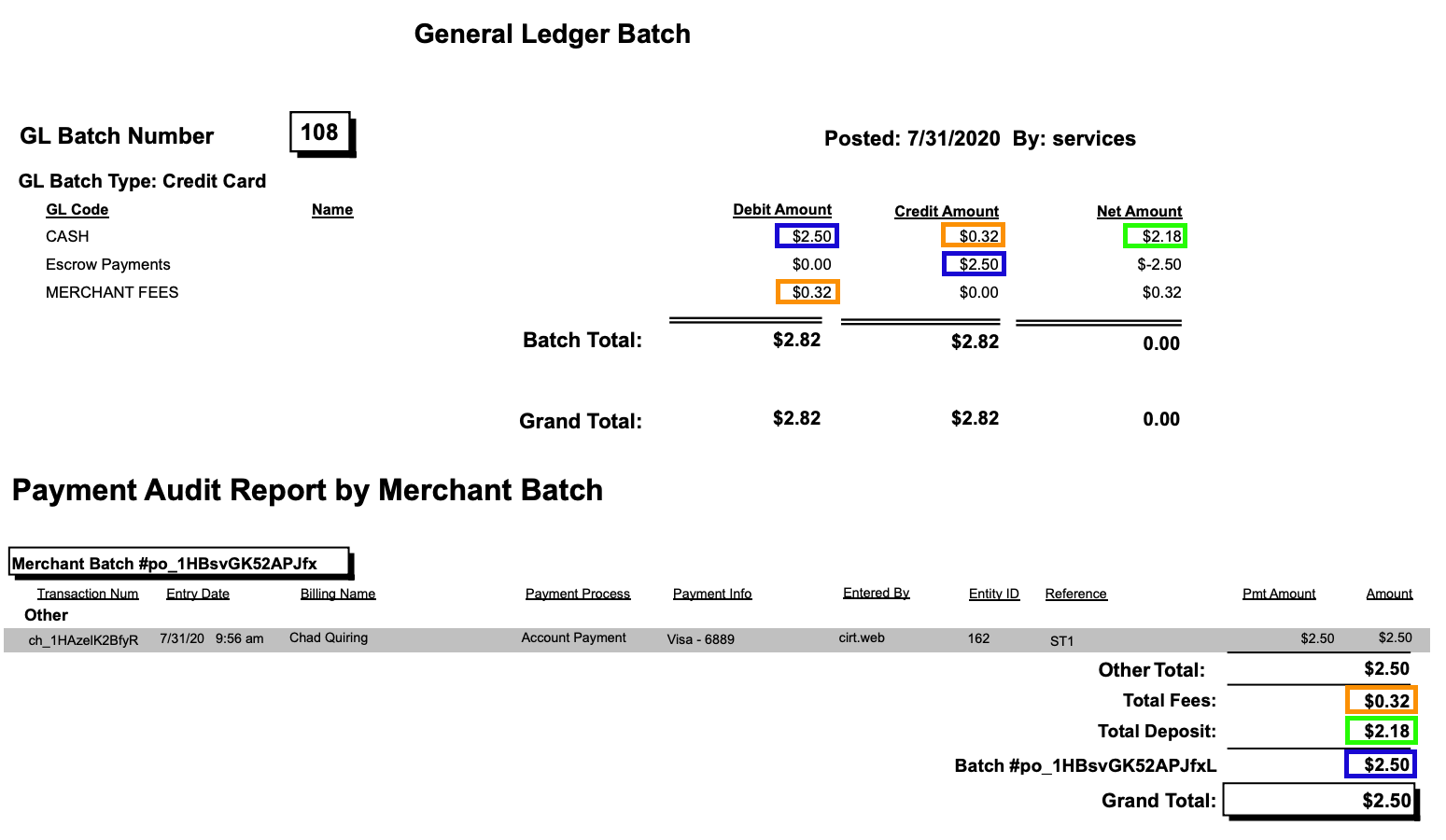

GL Batch Summary

The GL Batch Summary report is used to show the journal entries to make in your General Ledger.

- CASH – GL Code for your bank account where the funds are deposited. How do I configure Payment Processors?

- Escrow Payments – Deferred GL Code for AR Categories 4 – Refund of Credit Balance, 8 – Account Payment, and 9 – Transfer Payment.

- MERCHANT FEES – GL Code for fees charged to you by CircuiTree for processing. These fees come out of each batch.

Reconciliation via Reports

On a day when you have payment processed, as part of the Nightly Process you will be emailed the GL Batch Summary and Payment Audit by Merchant Batch reports. The following are time frames for when batches will be deposited in your bank:

- Credit Card – 2 to 3 business days after the batch is created.

- eChecks – 5-10 business days after the batch is created.

Here are the steps to use these reports to reconcile to your bank account.

- Once the batch has deposited to your bank, on the Payment Audit by Merchant Batch report reconcile the Total Deposit amount with the amount deposited in your bank account.

- Next, on the GL Batch Summary report, reconcile these fields with the Payment Audit by Merchant Batch report:

- Cash (Debit) -> Batch Total

- Escrow Payments (Credit) -> Batch Total

- Merchant Fees (Debit) – Total Fees

- Cash (Net Amount) – Total Deposit

- From the GL Batch Summary report, add three journal entries to your General Ledger based on Net Amount.

- Cash – $2.18

- Escrow Payments – ($2.50)

- Merchant Fees – $0.32