Surcharging is an option to pass the cost of payment processing on to your customer. For example, if there is a payment of $100, and your transaction cost is 3%, you would add a $3 surcharge for the payment.

There are several items to consider before you enable surcharging for your organization. Surcharging rules come from the card brands, not from Stripe or CIRCUITREE. As the Merchant, your organization has agreed to follow these card brand rules when you accept the processor’s terms of service. As a result, any potential liability for surcharging is assumed by the Merchant, and not CIRCUITREE. Card brands instituted the policies so that Merchants do not apply restrictions, conditions, disadvantages, or fees when the Card is accepted to create an incentive/disincentive for one card type over another:

- Surcharging only applies to credit card payments. Debit card and eCheck transactions are prohibited from surcharging.

- The surcharge percentage must be the same across all card brands (cannot charge more for one card brand than you do for another). Also, if you utilize surcharges, you must assess the surcharge across all card brands (cannot exclude certain card brands).

- You must select a surcharge percentage that is the less of either the lowest total processing cost of a specific card brand OR 3%, if all card brands have a total processing cost of more than 3%. In this scenario, 3% is a hard cap.

- EXAMPLE 1: Visa/Mastercard total processing cost of 2.5%, AmEx and Discover total processing cost of 3.5%. You can set a surcharge rate of no more than 2.5% for all card types

- EXAMPLE 2: Visa/Mastercard total processing cost of 3.5%, AmEx and Discover total processing cost of 4.5%. You can set a surcharge rate of no more than 3% for all card types

- Credit card surcharge permissions may vary by state, regulatory, or card network rules. Contact a tax professional or your local government for further guidance on whether your area permits surcharges.

- Amex Merchant Reference Guide – section 3.2 on page 7.

- Visa Surcharge Q&A

- Mastercard Surcharge Q&A

Configuration

To enable surcharging, you will need to determine the following. Once you have that information, you will submit a ticket to Support with the subject line of “Enable Surcharging.” Note: You will NOT need to contact card brands to notify them you are enabling surcharging

- The % rate that you want to charge.

- Reminder that the surcharge must not exceed your total processing cost for your lowest card cost OR 3%, whichever is less.

- This rate will be applied to all card brands (cannot exclude certain brands).

- AR Category to track surcharges.

- Best practice is to create a new AR Category called “Surcharge.” How do I configure AR Categories?

- The AR Category used for surcharge MUST be set to “Non Refundable.”

- We recommend NOT setting the Surcharge AR category as a Service Fee

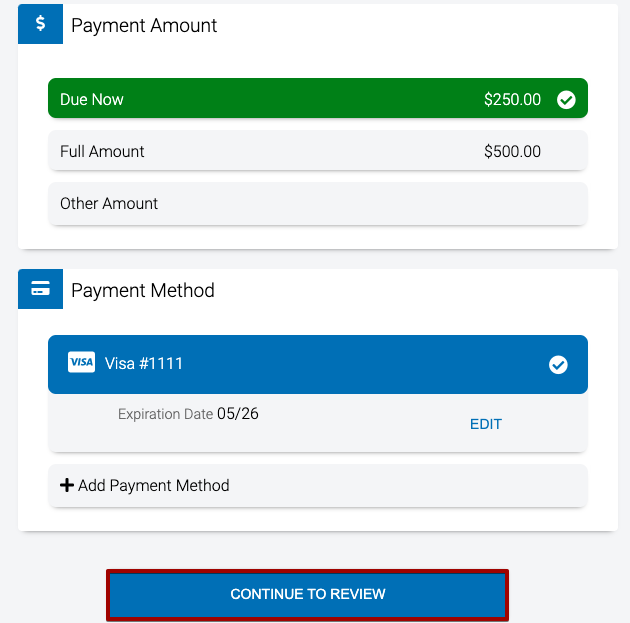

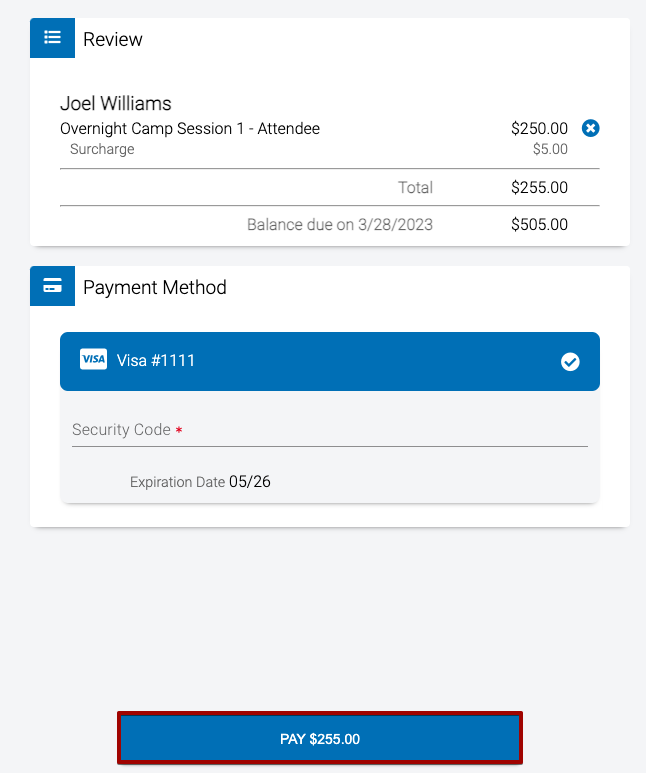

Registration Site

When surcharging is enabled and a customer goes through checkout or makes a payment on the Registration Site, this is their experience.

- Fill out the information during Checkout and select Continue to Review.

- The summary will be presented again with the Surcharge displayed. Select Pay to complete the checkout process.

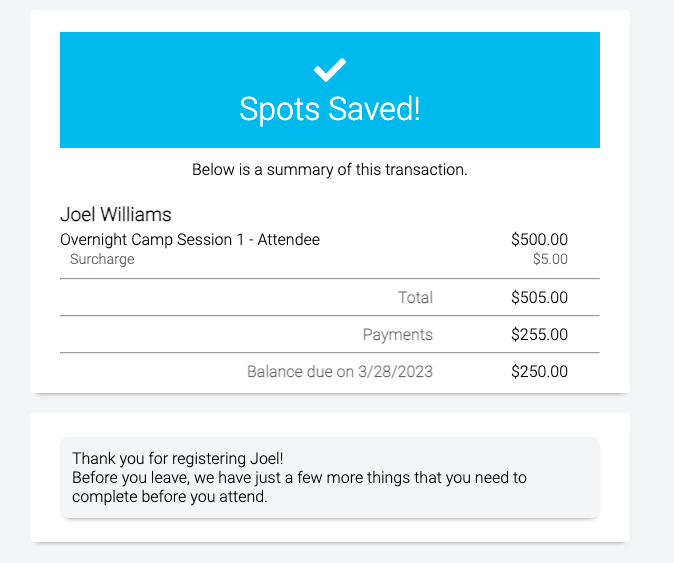

- The surcharge is displayed on the Spots Saved screen.

CT6

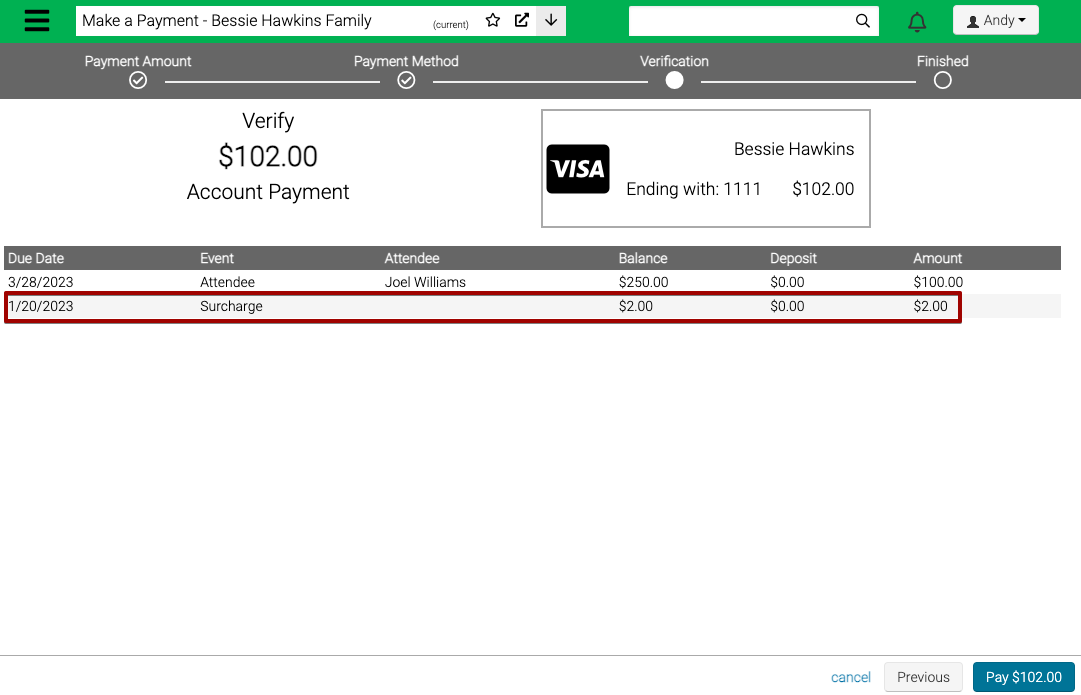

When you are making a payment in CT6, if a credit card is used, the Surcharge will be added during the Verification step.

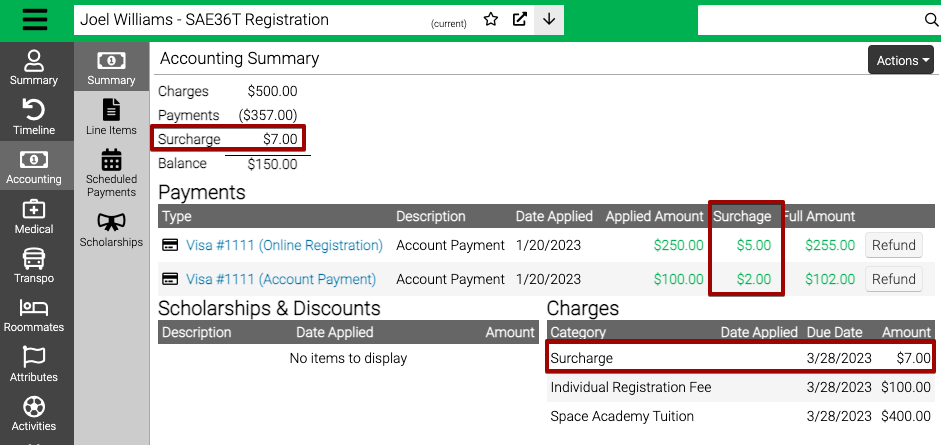

Surcharges are also displayed under Accounting.

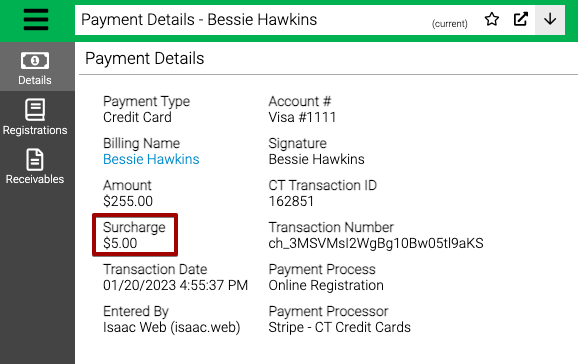

Surcharges are also displayed under Payment Details.

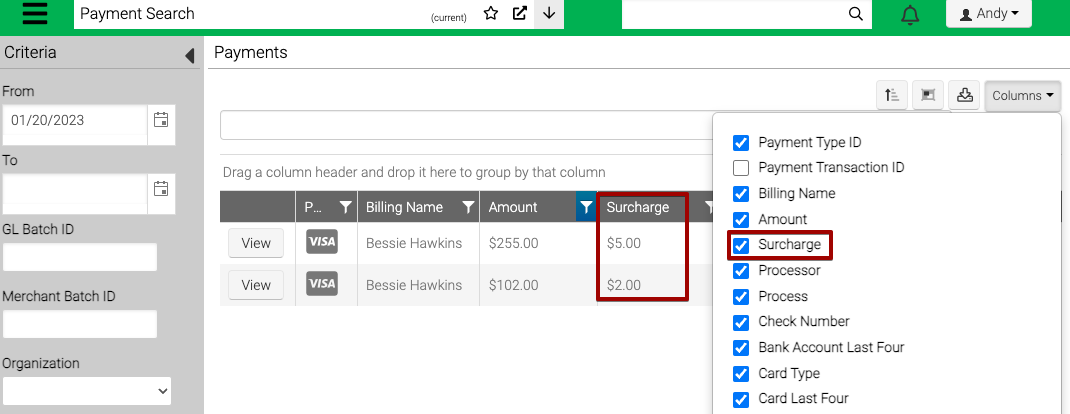

You can also view Surcharges under Payment Search.

FAQ

How do I see how much I have surcharged?

- You can run the query Payment – Surcharge to see a record of surcharges.

Are surcharges added for Scheduled Payments?

- Yes, when a Scheduled Payment using a credit card is processed, the surcharge will be added.

What reports include surcharges?

- The following global reports have been updated to include surcharges when they are present. If you have customized any of these reports, please submit a ticket to Support to update.

-

Statement – Child

-

Statement – Family

-

Statement – Group

-

Statement – Guest Group

-

Statement – Individual

-

Batch Statements – Child

-

Family Statement (Date Range)

-

Registration Letter – Group

-

Registration Letter – Child

-

Registration Letter – Family

-

Registration Letter – Individual

-