Oftentimes, your organization’s tax setup can be fairly complex, so we’ve made some changes that will allow you tax certain locations and aspects other than just your camp’s store items. Here’s how you do it.

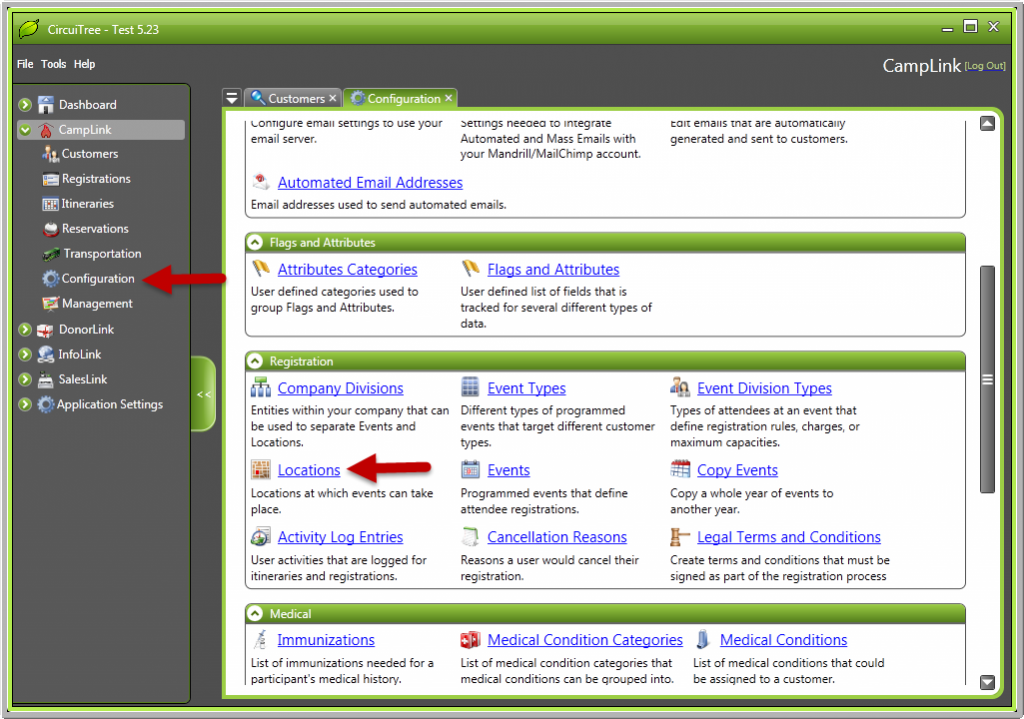

1. Navigate to CampLink > Configuration > Locations.

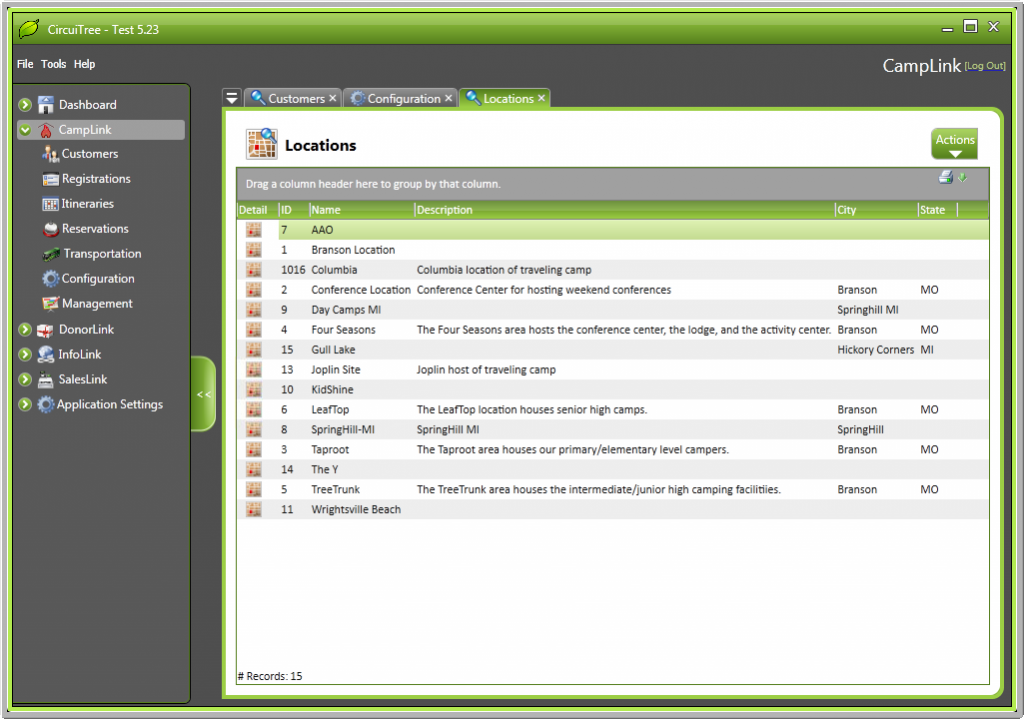

2. Select a location and click on the “Settings” tab.

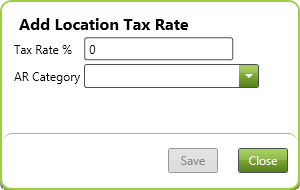

3. From here, you can right click to add a tax rate percentage and the AR category for the tax. Now your location is set up to charge tax. But there are a few more things that need to be configured first.

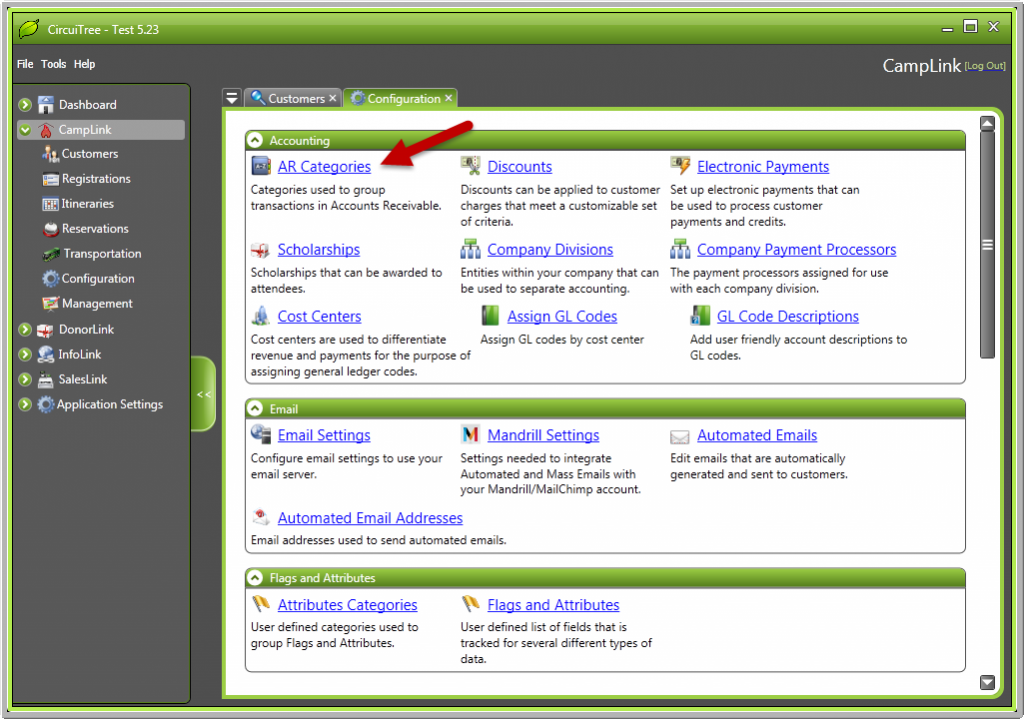

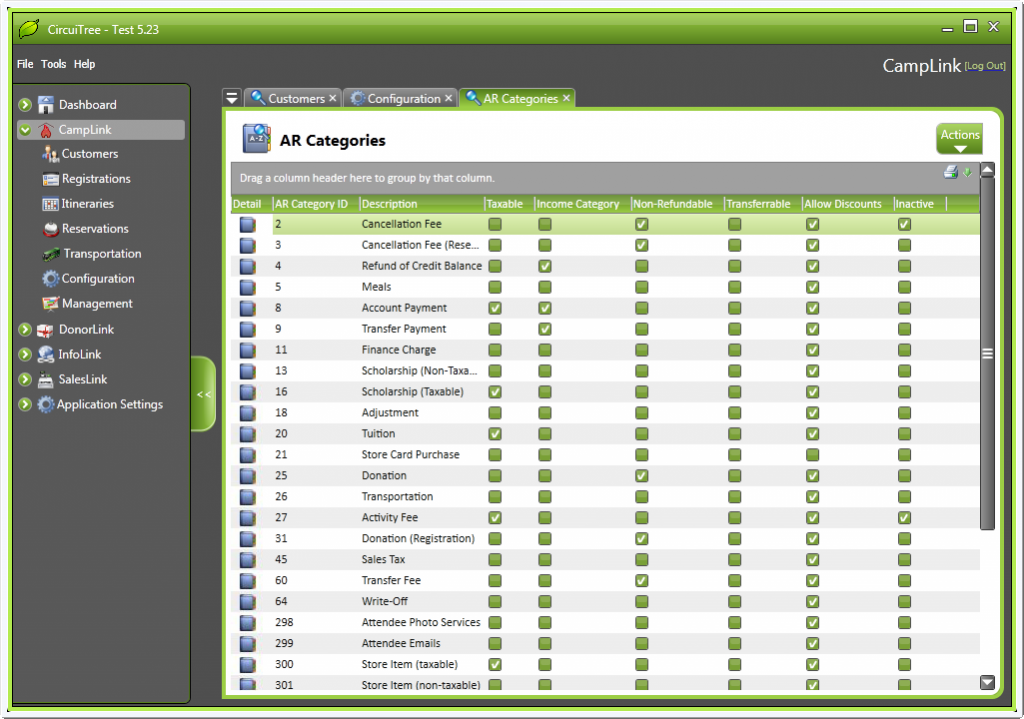

4. Go to CampLink > Configuration again and select “AR Categories”.

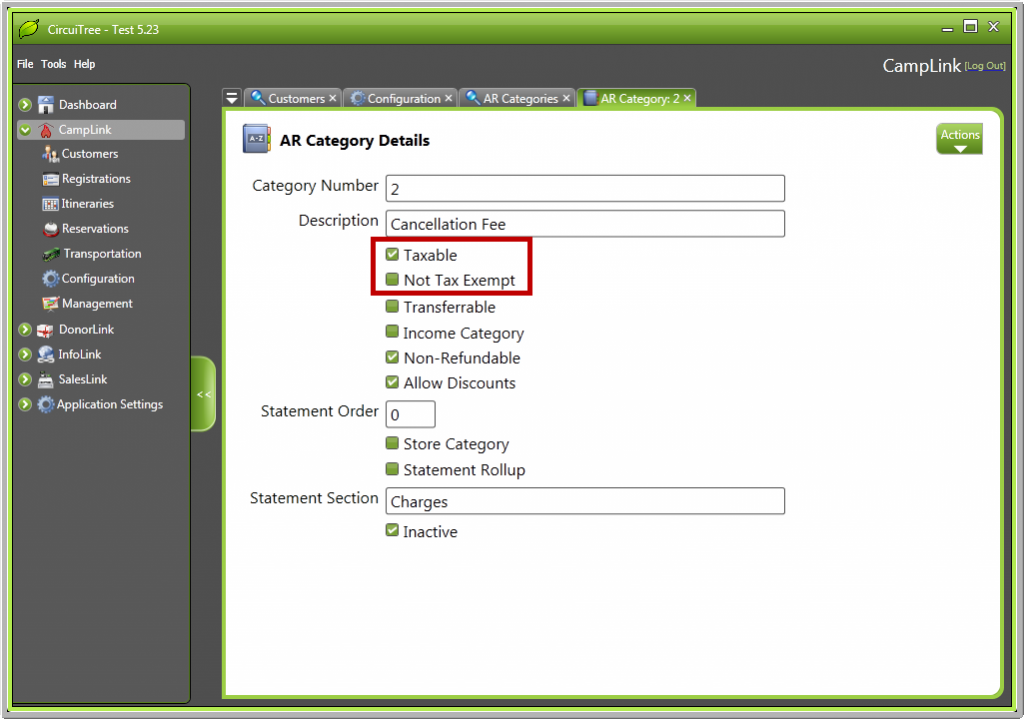

5. From here, open a category.

6. You’ll see here that you now have the option to make an AR category taxable. When you do that, it automatically creates another option called “Tax Exempt”. By marking an AR category as taxable, any charges with that AR category will include tax. However, if you mark it “Tax Exempt”, organizations that are tax exempt will be able to exclude taxes on those charges.

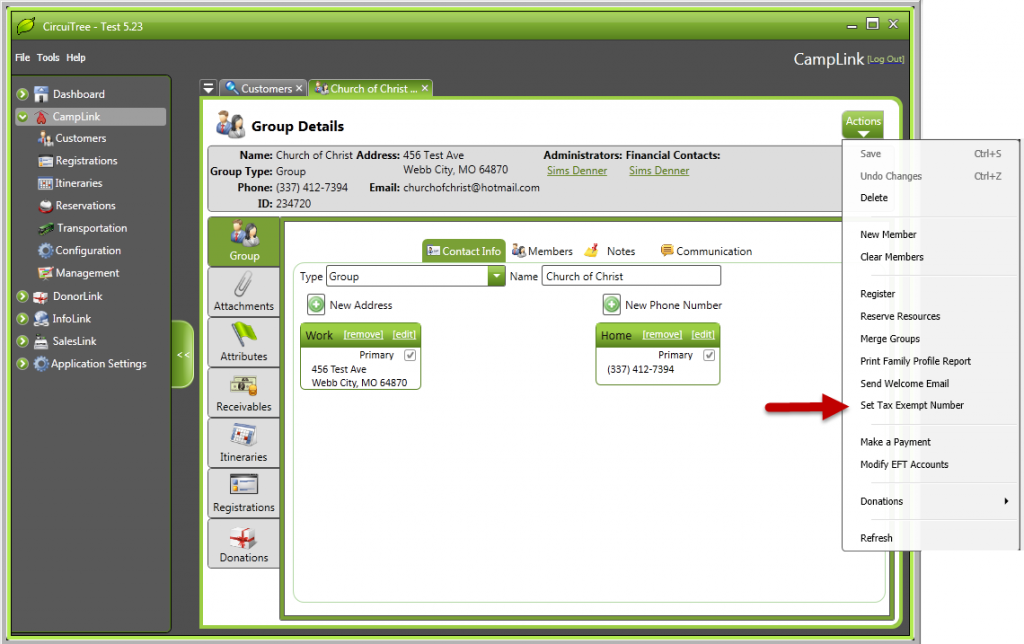

7. Speaking of setting a tax exempt organization, here’s how you do it: Open a group. Go to the “Actions” tab and select “Set Tax Exempt Number”.

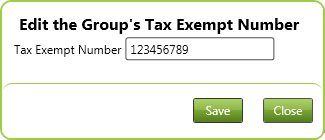

8. In the pop-up that appears, enter the group’s tax exempt number and save. Now the number will appear in the gray bar at the top of their account.