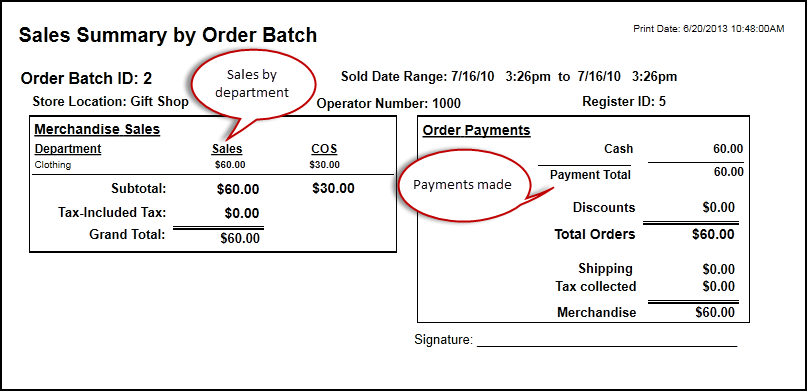

Every time you close your SalesLink register, your current sales are closed into an “Order Batch”. There is a report generated for you at that time that summarizes the activity in that batch of orders. This report can also be reprinted at any time from within Circuitree as the “Sales Batch Summary” report. The “Sales Batch Summary” answers two basic questions: 1) What did I sell for how much? and 2) How was it paid for?

Payments can be made in one of several ways:

- Cash

- Check

- Credit Card (Mastercard, Visa, etc—whatever you have allowed)

- Charge to Department (when you’re “selling” items to other departments of your company at cost.)

- Store Card (these are the store card accounts set up within Circuitree by your customers as part of their registration.)

Once you have the funds from the previous pay methods, you add “Discounts” (which are another form of ‘payment’ for the items you sold) and this gives you the “Total Orders” number.

Now, there are other things that you could have charged for besides merchandise including “Shipping” (from webstore orders) and “Sales tax”. Once you subtract those out, the amount you are left with is the amount you rang up for “Merchandise”, which matches the lefthand side of the report.

An Explanation of Sales Tax On the Report

When you create an inventory item in Circuitree, you can set its taxable status up in one of three ways:

- Non-Taxable: no sales tax is charged

- Taxable: sales tax will be charged as a separate item, above and beyond the sales price you set

- Tax-Included: sales tax will be paid to the government, but it is included in your sales price as part of the merchandise for your customer

Looking back at our original report, the “Actual Sales” in the amounts for each department do NOT include the part of your merchandise sales that you will pay out in sales tax. So if five cents of that dollar candy bar will be paid out to the government as sales tax, your actual sales in the totals in each department will be ninety five cents, and then five cents will be on the “Tax-Included Tax” line. That is because it is treated as merchandise sales to the customer, and that number is what is being balanced in the report. If it is taxable, then the amount given to the customer as merchandise would be one dollar, and the additional five or six cents of tax is shown on the righthand side, as sales tax that is explicitly charged to the customer AS tax.

Now, when you fill out your sales tax form for the government, you need to know how much to report as sales! The Sales Batch by Summary report can give you those numbers if you do not mix taxable types. For example:

- If all of your sales are taxable items, then the total merchandise sold number is your taxable sales, and the tax amount on the righthand side is the amount to pay the government.

- If all of your sales are tax-included items, the total merchandise line at the bottom is your taxable sales with all of the tax included. In that case, the subtotal of sales by department on the righthand side is your taxable sales, and the ‘tax-included tax’ is the amount you pay the government.

- And if all of your sales are non-taxable, you don’t even need to worry about this!

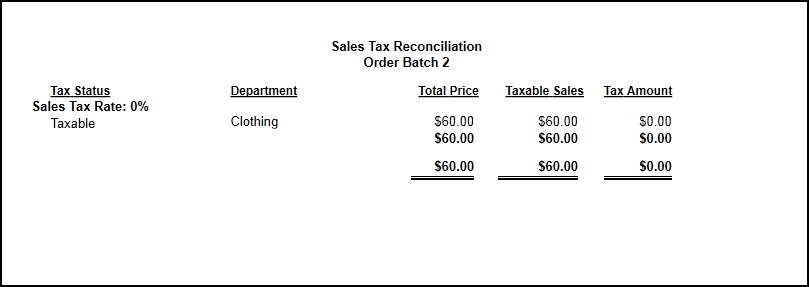

But what if you have some of all three? Then you need to run the “Sales Batch Tax Reconciliation” report for your batch. This lets you see how much you sold from each department for each tax status. It shows you how much of it is taxable sales and how much tax you give to the government.